Despite the lowest real estate inventory levels in years, sales figures in Steamboat for the first quarter of 2018 were surprisingly quite healthy. While slightly down from the same time last year, through March 2018, just over 200 properties were sold totaling over $135M.

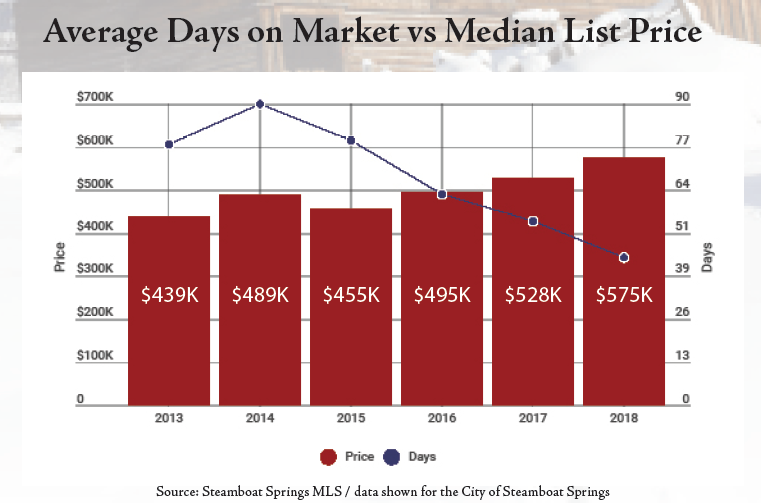

While we’re hopeful to see significant increases in inventory as the snow melts, it’s doubtful that we’ll return to levels seen over the last few years; this, of course, will lead to continuing price escalation. New listings in February (74) were only half of what we’ve seen hit the market in previous Februarys. New list prices continue to rise significantly as homes hitting the market are priced higher by nearly 9% from 2016, averaging $575,000.

Home prices are rising at the same time mortgage rates are rising. 30 year fixed mortgage rates now average close to 4.45%, up from below 4% at the beginning of 2018. With the Feds hinting at 2-3 more rate hikes this year, perhaps buyers are rushing to purchase before mortgage rates rise again. Still, rates are near historic lows, just not near recent lows.

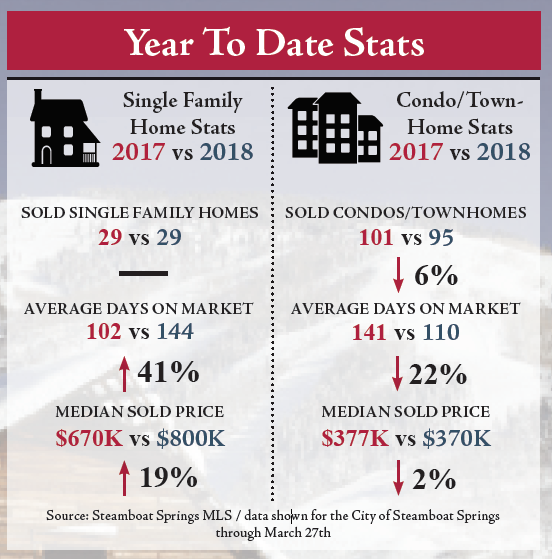

Historically, when single-family home prices shoot up, more people, especially first-time buyers, choose lower priced condos and townhomes. With an YTD average price of $416,000, condos and townhomes are significantly less expensive than single-family homes with a YTD average sales price of $733,000.