A commercial real estate purchase not only provides a place to conduct business, it also can produce an excellent investment opportunity. Investors often purchase commercial real estate as a means to secure future cash flow (or realize investment income). A sophisticated investor compares potential returns against other opportunities in the market, such as stocks and bonds.

With the stock market on an incredible nine year bull run, many investors are pulling profits to move to other investment opportunities. Traditionally, commercial real estate has been an especially strong performer. While a stock relies on its sale to realize non-dividend income and a bond needs to be held for a specified timeframe, commercial real estate can generate cash flow immediately.

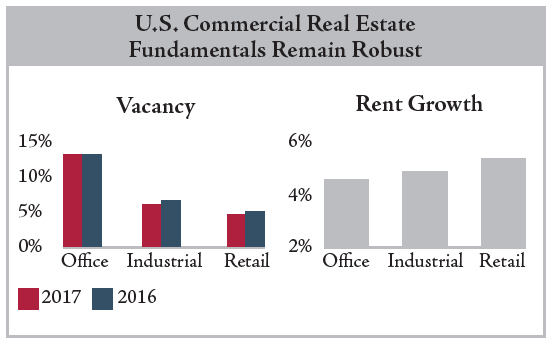

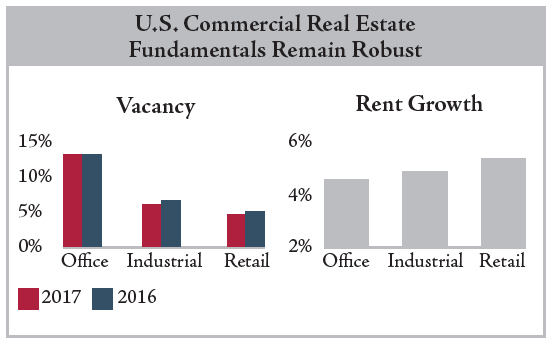

All investments, as we know, come with some risk. For commercial real estate investments, rents can decrease in a down market, vacancy can create detrimental periods of diminished cash flow, and landlords can absorb rent concessions or improvement expenses to secure good tenants. A good building in a strong location, however, should be able to generate steady and competitive cash flow.

If a real estate investment fits your goals, we’re happy to model the finances for any property in town.